Intro

You may have heard countless times that search engine optimization (SEO) is a significant digital advertising tool. However, even with a basic understanding of this process, you may still not fully grasp how it can help modern entrepreneurs, including online lenders.

SEO comprises multiple elements, and knowing the best practices is critical to mastering all these aspects. With the right strategies, online lending websites can improve their reach, visibility, and user experience.

Why SEO matters

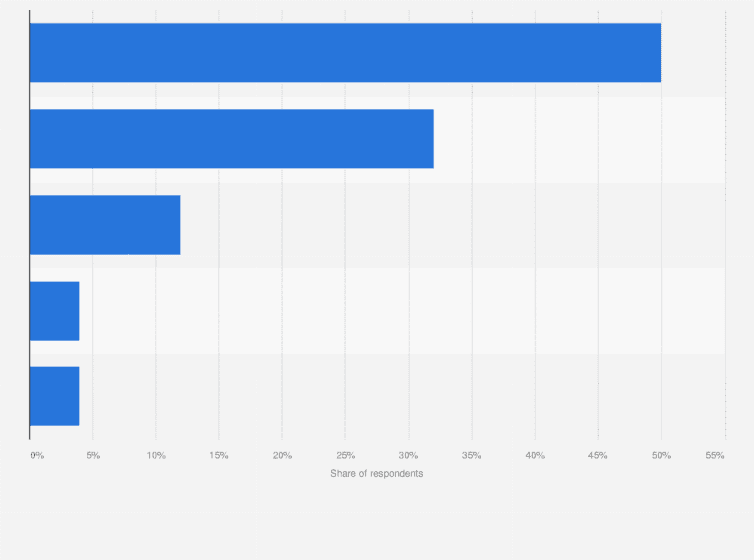

Improving a website's searchability and visibility is an obvious benefit of SEO, but its value extends beyond these aspects. In a survey of marketing professionals, half of the participants said SEO had a significant positive impact on ad performance and goals in 2022.

Image from Statista

The numbers prove that the growing importance of SEO stems from crucial advantages beyond mere visibility. Let us explore why optimization can be indispensable for online lenders aiming to elevate their brand reach.

Builds credibility and trust

An expert SEO strategist aims to establish a strong foundation for a visually appealing website and provide a seamless user experience, ensuring easy discoverability through search results. Achieving this feat can help build credibility and trust among potential clients.

Different elements contribute to gaining authority through search engines, including natural links, positive user behavior, and machine-learning signals. Optimized on-page content also helps establish trust for online businesses.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

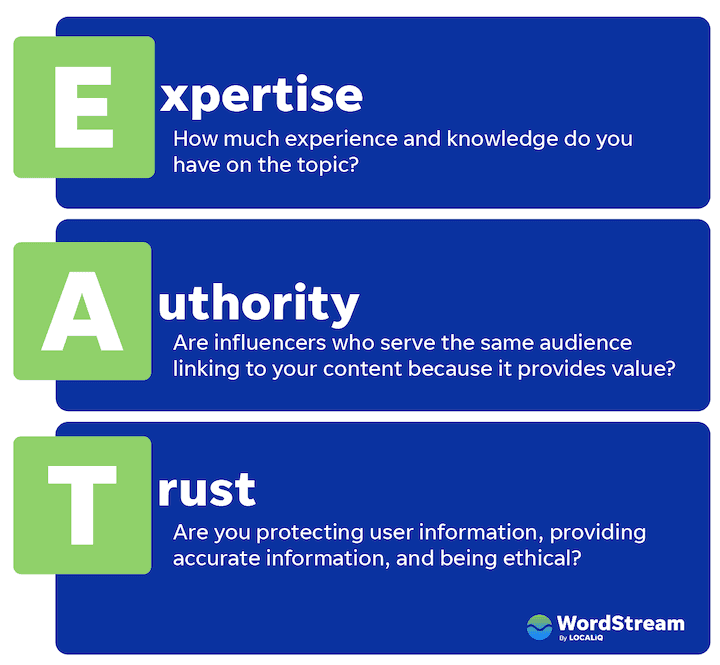

Building authority takes time and should align with Google's E-A-T guidelines. Online lenders will need an SEO strategy and a unique approach that instills trust in customers.

Image from Wordstream

Helps understand customers

SEO provides valuable insights into customer preferences, ranging from the finer details of consumer intent to macro-market trends. Through various data sources like search queries, search engine results page (SERP) analysis, and analytics, SEO can help marketers understand user behavior and intent.

Achieving a high placement in organic search results demonstrates authority, fostering trust among internet users and boosting the likelihood of site visits and conversions. Google, which users consider to be a trusted digital resource, contributes to trust transference.

With a high rank in organic search results, you can show customers that you are earning clicks and traffic not only through paid ads but through relevance.

Improves user experience

SEO and user experience (UX) are interconnected, with positive UX contributing to improved SEO results. A positive interaction between customers and the website leads to a higher number of clicks, enhanced traffic, and, ultimately, improved SEO performance.

Improving technical SEO aspects contributes to a positive visitor experience. Mobile optimization, including responsive design and effective calls-to-action (CTA) placement, ensures seamless functionality on smartphones.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Furthermore, easy site navigation, logical URL structures, and a well-organized internal link structure contribute to a user-friendly environment, facilitating quick access to crucial information.

5 SEO strategies for online lenders

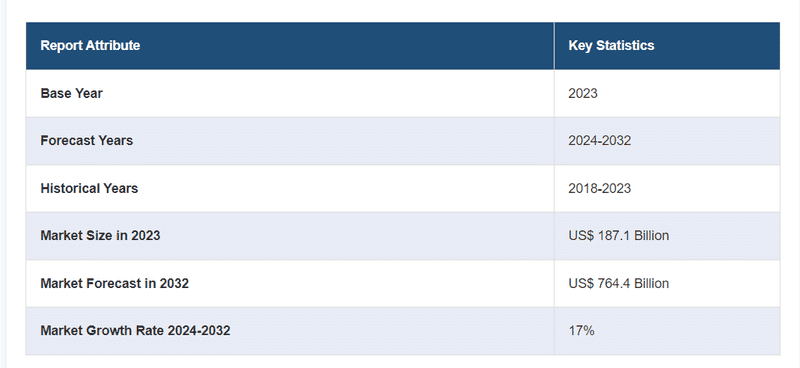

The fintech landscape has experienced significant growth, with the market growing to $187.1 billion in 2023. Today, consumers rely on fintech apps to get access to various banking services and even apply for a personal loan.

Image from IMARC Group

Online loan providers need effective marketing tactics to put themselves in the most profitable position as the market grows. The SEO practices below can help online lenders expand their reach and elevate their advertising campaigns.

1. Use high-quality backlinks

It is crucial for online lending businesses seeking to maximize their online visibility to have a strategic focus on identifying high-authority domains within the financial sector.

Prioritizing domains considered thought leaders and trusted sources of information in the financial industry can significantly enhance the profile of a lending website. As a result, this strategy augments the credibility and search ranking of the brand’s financial offerings.

The effective execution of this strategy involves using tools that streamline the process of discovering high-authority platforms. After finding the platforms, marketing officers can tailor their content strategy to align with the specific interests and needs of these top-tier sites. This customization involves performing a comprehensive backlink analysis to determine the authority of potential linking domains.

Additionally, lenders can try link-building through guest posting and blog writing designed for quality publication matches. Link-building can further improve relevance and value while fostering relationships between your business and publishers.

To become an SEO expert, you must have a profound understanding of consumer behavior to develop content that stands out in a highly saturated market. You can also use different SEO tools to ensure that every article, guide, and market analysis you publish resonates with your target audience and search engines.

This strategy ensures that each piece of content not only addresses the audience's informational needs but also meets the requirements of search engines and high-authority linking domains. Proper execution of this tactic can contribute to a more robust online presence.

2. Create user personas

The foundation of any successful SEO approach lies in a deep understanding of your audience. Remember that the financial services sector caters to a diverse audience, from individual consumers pursuing personal banking solutions to corporate entities looking for investment advice. Marketers must discern the distinct categories of customers and meticulously develop detailed personas for each segment.

These personas should encompass a comprehensive array of characteristics, delving into the following elements:

- Age demographics

- Income levels

- Financial aspirations

- Types of content they enjoy reading

- Search behaviors

For example, the preferences of younger audiences might revolve around topics like "mobile banking solutions," reflecting their needs for technologically-driven financial services. Meanwhile, a small business owner may search for information related to "small business loan requirements," underlining their need for more funds for their business venture.

By creating these customer personas, you can develop a precise SEO strategy that helps you tailor content, keywords, and approaches that resonate with each identified segment. This understanding allows financial service providers to align their online presence with their audience's diverse needs and preferences.

3. Rely on strategic keyword research

The ability to navigate search engine algorithms can make or break an online lending business. To help in this effort, you must have an SEO strategy fueled by strategic keyword research. This process serves as the pillar that provides the precision necessary to find specific search terms and phrases your prospects enter into search engines.

Marketers can enhance their web presence and surpass competitors in search results by analyzing competitive landscapes and identifying untapped keyword opportunities. Using long-tail keywords will also enable them to capture niche markets. Meanwhile, understanding local search dynamics can ensure relevance to regional audiences.

Online lenders can use SEO tools to get valuable insights necessary to secure a prominent position in online search visibility. There are digital solutions that help marketers study competitors' keyword usage, revealing vulnerabilities and opportunities they can use to create a better SEO campaign.

Through SEO tools, online lenders can refine their target keywords that illuminate the path toward top search engine placements. These placements are crucial not only in improving products and services but also in capturing the attention of potential borrowers. By incorporating competitor analysis into their SEO approach, lenders gain a competitive edge and position themselves for success.

4. Plan a content strategy

Developing an effective SEO strategy involves more than publishing random content. It requires thoughtful cultivation of topical authority, which refers to a website's recognized expertise and credibility in a specific subject area. Your brand’s topical authority will be determined by the depth and quality of your content on that subject.

You will need a strategic approach to have topical authority over various financial discussions. To start the process, you must choose a specific topic within your financial services domain. This could be a particular financial service you aim to highlight or an area that you are knowledgeable about. For example, if your forte lies in retirement planning, consider making it your chosen topic for building topical authority.

You will need a comprehensive content strategy centered around your chosen topic. Start with a substantial pillar page. This page can be an extensive piece offering an overarching view of retirement planning. The pillar content can also function as a central hub, covering the general topic comprehensively and providing valuable insights.

After developing the pillar content, you must publish a series of cluster content. These pieces are shorter and more focused content that discusses subtopics related to retirement planning.

Ensure each cluster content piece links back to your pillar page to create a cohesive internal linking structure. This tactic signals to search engines that your website boasts depth and quality content on your chosen subject.

Content planning enhances your site's visibility in search results and positions your business as a trusted and knowledgeable resource within your industry.

5. Work with partners to improve link strategy

The most successful online lenders know that industry partnerships can positively impact their journey to broaden their digital footprint. Creating connections with professional associations, local business coalitions, and educational institutions within the industry can be a catalyst for reciprocal backlink exchanges.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

This SEO strategy not only bolsters site rank but also extends domain authority. You are strengthening your company’s online presence by appearing on industry-relevant websites.

With the help of SEO tools, you can boost online visibility while solidifying the reputation of your website. This approach highlights your financial platform’s relevance in the niche of lending. It demonstrates a distinct level of expertise and trustworthiness that captivates the attention of search engines.

The symbiotic relationship fostered through these partnerships amplifies the digital reach of your business and elevates your site’s rank in search engines. As a result, your audience will perceive your platform as an authoritative source within the lending domain, making it more likely to be recognized and prioritized in search results.

Optimize your lending platform and get more clients

Getting top rankings on search engines requires a strategic, persistent, and knowledgeable approach. That said, you do not have to navigate the complexities of SEO alone. You can always work with SEO experts who can give you the advice you need to attract potential borrowers to your website.

With the help of SEO experts, you can rely on tailored and comprehensive SEO strategies that align with your brand’s unique business goals. These tactics can propel your lending platform to the forefront of search engine results and allow you to achieve sustained success in your niche.