Intro

Do you wish for a life that fulfilled your lucrative financial goals but not at the cost of killing your work-life balance?

Maintaining one or multiple passive income sources is the way to do so and people across the world are aspiring for it.

What is passive income?

Passive income means a source of income apart from your primary income source. It’s where you invest less time and effort and yet get a constant flowing income.

The main reasons people opt for passive income is to expand their flow of wealth, ensure financial security, som etimes to take an early retirement and even to learn new businesses and skill sets.

People opt for two-to three passive income sources and Building multiple passive income streams is one of the best approaches to achieving financial freedom.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Passive income is money you earn regularly with little ongoing effort required. Instead of trading time for money like traditional work, passive income generates cash flow whether you are actively working or not.

Developing even just 2-3 consistent passive income streams can eventually cover your living expenses without needing a job, leaving you with abundant free time to focus on your primary goals and priorities.

In today’s era relying on a single source of income not just keeps you on the edge but also risks your financial security in times of crisis.

Hence, around the world people are becoming actively aware about the sources of passive income to create long-term wae

Passive income is money you earn without having to work for it actively. So, Having multiple passive income streams can help create long-term wealth and financial freedom.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Here are over 30 great passive income ideas you can start in 2024:

1. Rental Property Income

Buying rental properties and renting them out is a classic passive income strategy. As a landlord, you earn regular rental income with little day-to-day effort. To streamline property management tasks such as rent collection, tenant communication, and maintenance scheduling, consider using property management software.

Pros

- Build equity as the property appreciates over time

- Tax benefits like depreciation deductions

- Hedge against inflation through rising rents

Cons

- Large upfront investment

- Ongoing maintenance and repairs (though you can hire one of the best vacation rental management companies in the area to handle these responsibilities and ease your workload)

- Periods of vacancy between tenants

2. Dividend Stocks

Dividend-paying stocks generate regular passive income through quarterly dividend payments. All you need to do is invest in dividend stocks and collect the checks.

Pros

- Low maintenance

- Dividend aristocrats can offer stable payouts

- Tax advantages when investing through a Roth IRA

Cons

- Stock prices can fluctuate

- Companies can reduce or eliminate dividends

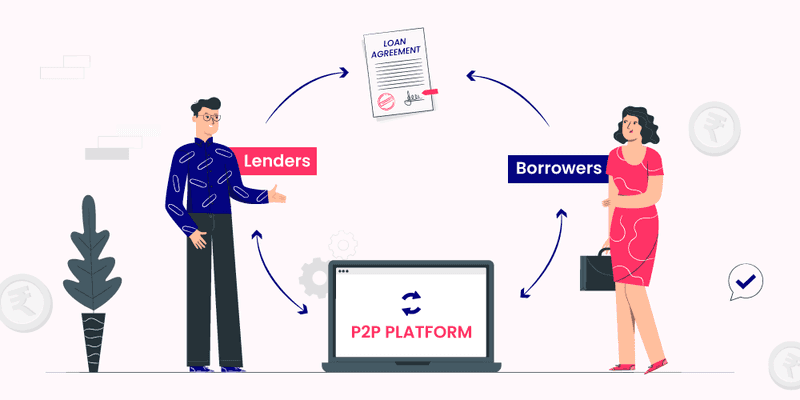

. Peer-to-Peer Lending

You can earn interest by lending money through peer-to-peer lending platforms like Lending Club and Prosper. Your capital gets matched to creditworthy borrowers looking for loans.

Pros

- Earn annual returns of 5-10%

- Low investment amounts like $25

- Automated and hands-off

Cons

- Relies on borrowers paying back

- Higher default risk than bonds/savings accounts

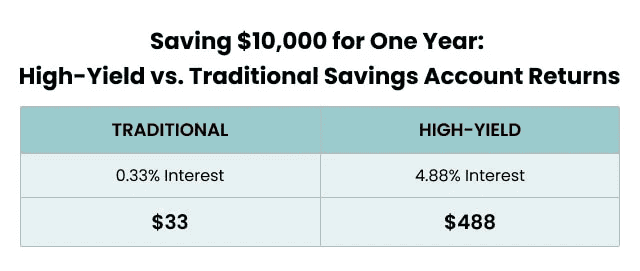

4. High Yield Savings Accounts

Today's online savings accounts offer much higher interest rates than brick-and-mortar banks. Opening a high-yield savings account can generate easy passive income.

Pros

- FDIC insured up to $250,000 per bank

- No risk like stocks/bonds

- Liquidity to withdraw anytime

Cons

- Interest rates are still low compared to investing

- Must shop around for the best rates

5. Affiliate Marketing

Partner with brands and earn commissions promoting their products/services like hotels booking and flight bookings on your website and social media.

Hotelsfor18 is one of the great example of affiliate marketing who recommend best hotels to stay in United States.

The best part is that you get paid on autopilot once you make the initial referral.

Pros

- Very low barrier to get started

- Recurring commission checks

- Build an audience and following

Cons

- Reliant on consistent website traffic

- Commission rates can change

- Need multiple successful partnerships

6. Selling Digital Products

Create digital products like ebooks, courses, templates and graphics that customers can purchase and download online. Every new sale is passive income.

Pros

- Very high profit margins

- Make money while you sleep

- Scalable with small incremental costs

Cons

- Upfront time investment to create

- Need expertise or hiring

- Marketing ongoing costs

7. Blogging

Earn advertising and affiliate revenue by building an audience around your blog on a topic you're passionate about. Blogging can become quite passive once established.

Pros

- Turn your passion into profits

- Mix of active and passive income

- Low startup costs

Cons

- Significant time to build traffic

- Inconsistent fluctuating income

- Need fresh content regularly

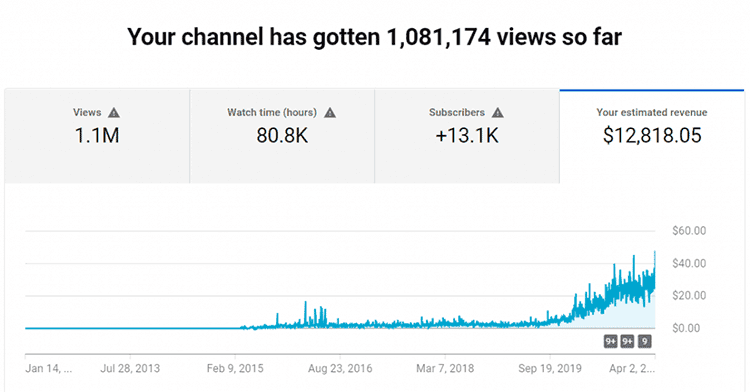

8. YouTube Channel Revenue

Building a YouTube channel allows you to earn ad revenue from YouTube, sponsorships, merchandise and more. Your videos continue generating residual income.

Pros

- Free to start and post videos

- Potential to go viral

- Ad revenue shares up to 55%

Cons

- Need lots of high-quality content

- Long ramp up time

- Very competitive space

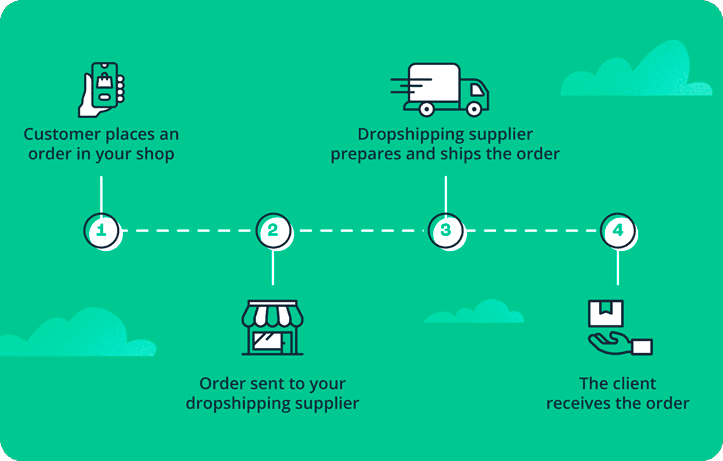

9. Dropshipping

Selling products through online stores without actually stocking inventory. When a sale occurs, you order it from a supplier who ships it directly to the customer.

Pros

- Very low startup costs

- Easy to scale

- Third parties handle shipping and returns

Cons

- Low profit margins

- Reliant on suppliers

- High competition

10. Vending Machines

Placing vending machines in strategic locations can earn you passive income 24/7 from automated sales. Best locations include offices, schools, gyms, etc.

You can check out Wendor for vending machine-related businesses and startups.

Pros

- Steady, recurring income after setup

- Cash business with no overhead

- Choose your own products and pricing

Cons

- Securing locations can be tough

- Ongoing restocking and maintenance

- Limited scalability per machine

11. ATM Business

Running a small ATM network by placing ATMs in convenient, high-traffic locations can generate steady passive income from transaction fees.

Pros

- Recurring income stream

- No inventory or variable costs

- Flexibility in choosing locations

Cons

- Large upfront investment

- Ongoing maintenance

- Compliance requirements

12. Peer-to-Peer Boat Rentals

Allow others to rent your boat through platforms like Boatsetter. You earn income whenever your boat gets booked while doing nothing.

Pros

- Earn significant rental income

- No maintenance or costs when not rented

- Insurance and vetting done

Cons

- Doesn't fully replace active charters

- Need proper storage, docking

- Restricted locations

13. Peer-to-Peer RV Rentals

You can track rental property income and expenses by listing your recreational vehicles on RV share platforms like RVshare. This enables you to monitor the income earned from renting out your RVs.

Pros

- Substantial earnings during peak season

- Extra income from unused asset

- Low maintenance while not rented

Cons

- Slow periods with no rentals

- Need insurance, cleaning, storage

- Reliant on limited platforms

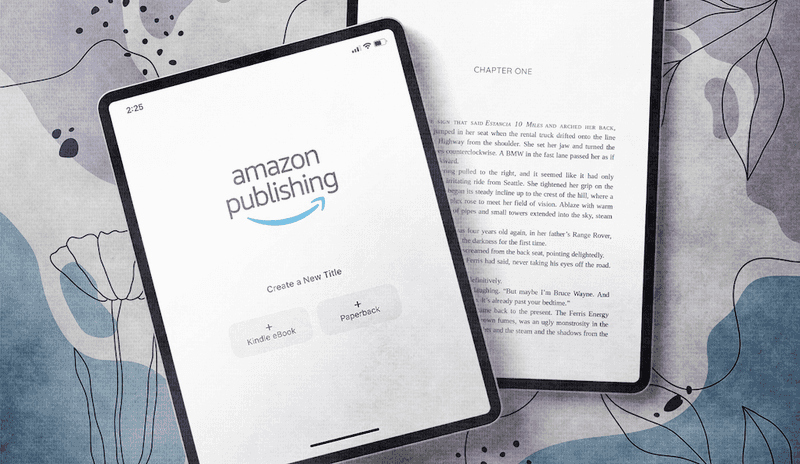

14. Self Publishing Kindle eBooks

Publishers keep earning royalties long after a book is published. With Amazon Kindle self-publishing, your eBook can keep generating income.

Pros

- True passive income for years

- Low costs to publish

- Build your author brand

Cons

- Significant upfront writing time

- Need marketing to stand out

- Low royalties on cheaper books

15. Sell Photos Online

Stock photography websites let you sell your photos to business customers on demand. Set up your portfolio once and watch the passive income roll in.

Pros

- Make money from existing photos

- Unlimited earning potential

- Own your work and license

Cons

- Pay per photo can be low

- Need a large portfolio

- Quality standards required

16. Rent Out Parking Spots

Apps like JustPark enable you to rent out unused driveway, garage and parking space to drivers looking for convenient parking.

Pros

- Earn solid hourly/daily rates

- Minimal effort after setup

- Flexibility to choose open days

Cons

- Inconsistent demand

- Need good location

- Space requirements

17. Invest in Royalties

Investing in royalty streams like music, films, patents and mineral rights pays you a share of profits without you doing any of the work.

Pros

- True hands-off passive income

- Grow income through more investments

- Diversification

Cons

- Large upfront investments

- High risk if underlying asset fails

- Complex deals and analysis

18. Rent out Equipment

Rent out expensive equipment like cameras, production gear, tools, furniture and electronics that are just sitting unused at your home or office.

Pros

- Turn idle assets into cash

- Flexible occasional commitments

- Marketplaces simplify logistics

Cons

- Sporadic irregular income

- Ongoing maintenance

- Need space to store inventory

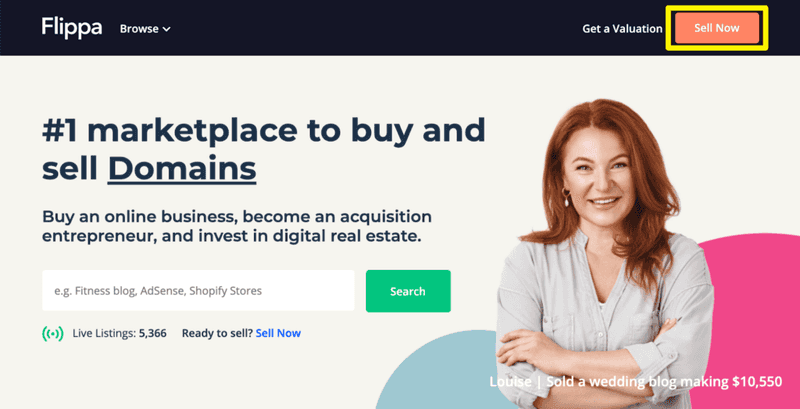

19. License and Flip Domain Names

Buy high-potential domain names for cheap and license or resell at a markup to interested buyers like startups and businesses.

Pros

- Ultra low-effort passive income

- Big profit potential from great names

- Easy scalability

Cons

- Need expertise in domains

- Can take time to sell names

- Some legal intricacies

20. Sell Stock Photography

Contribute stock photos to stock image marketplaces like Shutterstock or iStockphoto where they can generate passive income from license fees.

Pros

- Make money while you sleep

- Unlimited earning potential

- Own your work to relicense

Cons

- Low pay per photo

- Need a large portfolio

- Quality standards required

21. Modify Shipping Containers

Buy used shipping containers, modify them into apartments and tiny homes, and rent them out to tenants seeking affordable housing.

Pros

- Appreciating assets over time

- Unique modular properties

- Lower maintenance than traditional builds

Cons

- Large upfront costs and labor

- Permits can be challenging

- Limited scale per property

22. Rent out Pools

Let neighbors rent your swimming pool by the hour when you're not using it. Set your own rules and pricing.

Pros

- Substantial earnings in summer

- Apps simplify scheduling and payment

- Very hands-off management

Cons

- Slow/no income in winter

- Liability risks to manage

- Maintaining water and cleaning

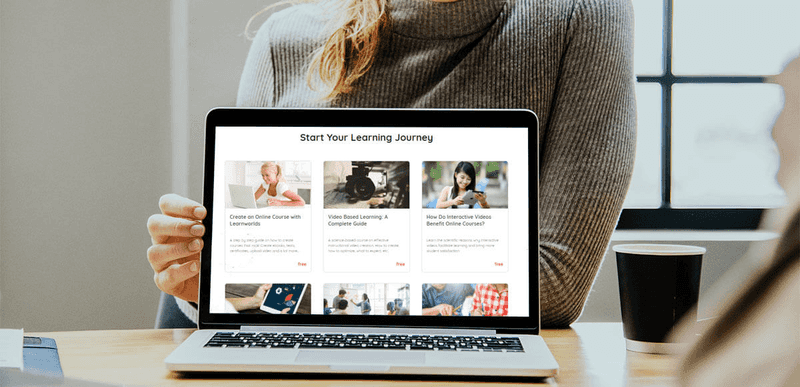

23. Sell Informational Courses

Create online courses teaching your expertise from everything from photography to code to wilderness survival. Each new student equals new passive income.

Pros

- Hands-off income stream

- Build authority and audience

- Backend potential with subscriptions

Cons

- Major time investment upfront

- Marketing and lead costs

- Ongoing customer service

24. Voice Acting Gigs

Leverage a home studio to record custom voice overs, audio books and other voice acting projects. The finished recording keeps earning you royalties.

Pros

- Flexible to do from home

- Decent hourly rates

- Ongoing residual payments

Cons

- Need professional equipment

- Very competitive industry

- Inconsistent work and income

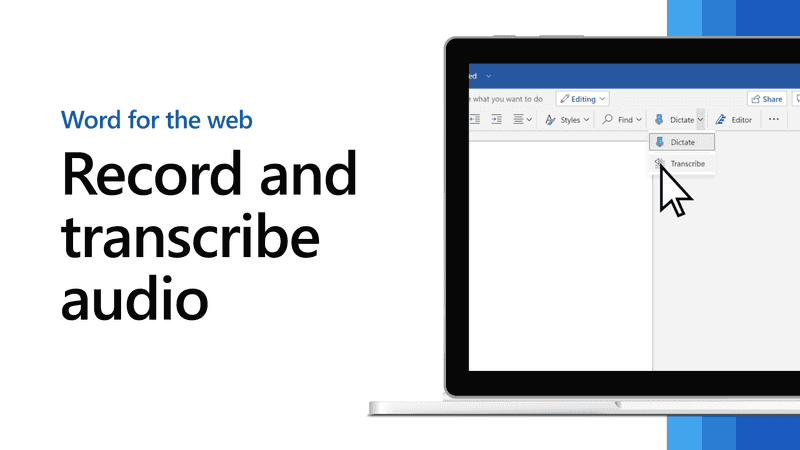

25. Transcribe Audio Files

Get paid to transcribe audio files for individuals and companies using just your computer. The files keep coming in for regular passive income.

Pros

- 100% work from home

- Steady demand for services

- Can outsource portions

Cons

- Tedious and tiring work

- Low pay per audio hour

- Need fast typing skills

26. Rent out Musical Instruments

Musicians and students often look to rent instruments like pianos, guitars and drums. Your gear can generate income when not being used.

Pros

- Turn unused gear into cash

- Rental demand often exceeds supply

- Low maintenance required

Cons

- Sporadic income

- Risks of damage and theft

- Equipment takes up space

27. Rent Out Your Car

List your car on rental marketplaces like Turo whenever you won't be driving it. Ideal for travel locations. You earn income with little effort.

Pros

- Substantial earnings, especially in cities

- Insurance and vetting done

- No wear and tear when not rented

Cons

- Availability needs to be high

- Cleaning between rentals

- Meet/greet for handoffs

28. Build a Membership Website

Offer exclusive content, tools, courses and more to paying members. Monthly subscriptions earn recurring passive income with minimal ongoing work.

Pros

- Predictable recurring revenue

- Build loyalty and community

- Upsell opportunities

Cons

- Major upfront time investment

- Ongoing creation of new content

- Technical challenges

29. License and Sell Audio Loops

Create original instrumental loops and sound samples that music producers can license and download royalty-free from marketplaces like AudioJungle.

Pros

- Make money while you sleep

- Build portfolio over time

- Own work to re-license

Cons

- Pay per loop is low

- Need musical expertise

- Ongoing creation needed

30. Lease out Billboards/Signage

Buy billboards, commercial buildings, trucks etc. and lease out the advertising space. Collect recurring passive lease payments each month.

Pros

- Steady long-term agreements

- Appreciating assets over time

- Low maintenance

Cons

- Large upfront investment

- Slow income growth per asset

- City regulations

31. Sell Your Software as SaaS

Develop software applications and tools then license access on a subscription basis. Manage and host everything online with minimal interaction.

Pros

- Monthly recurring billing

- Scales easily with usage

- Develop once, sell repeatedly

Cons

- High technical barrier

- Long development timelines

- Ongoing tech support needs

32. Develop Mobile Apps

Build mobile apps and games people use and pay for through the app stores. Residual income streams from recurring subscriptions and in-app purchases.

Pros

- Global reach and access

- Mostly passive income after launch

- Viral potential and word-of-mouth

Cons

- Very crowded space

- Ongoing updates and support

- Getting notice is challenging

- Write and Publish Ebooks

Self-publish ebooks online and earn royalties every time someone downloads your book. The more titles you have, the more potential income streams.

Pros

- Low costs to publish

- True passive income for years

- Use pen names for more books

Cons

- Major time investment to write

- Discoverability is challenging

- Slow sales growth per title

34. Invest in a High Cash Flow Business

Invest money into an existing offline small business like a car wash, storage facility or laundromat that has proven stable cash flows.

Pros

- Steady returns from an operating biz

- Appreciation over time

- Make money without day-to-day effort

Cons

- Obtaining financing can be hard

- No control or oversight

- Risk of declining performance

45. License and Sell Your Art

Upload your drawings, paintings and artwork designs to sites like Society6. Set it and forget it as each new order earns you royalties.

Pros

- Hands-off passive income stream

- Make money from existing work

- Build your portfolio and following

Cons

- Pay per unit sold is low

- Takes volume to build income

- Low margins overall

36. Rent out Your Driveway

Let travelers and commuters rent your empty driveway as parking through apps like JustPark. Unused space converts to cash.

Pros

- Steady earnings in cities

- Minimal effort after setup

- Flexibility in open hours

Cons

- Irregular demand

- Need good location

- Space requirements

37. Rent out Storage Space

Rent out unused attics, basements, sheds and garages for extra storage space. Apps like Neighbor handle scheduling and payments.

Pros

- Turn wasted space into cash

- Flexible occasional commitments

- Easy to scale up storage units

Cons

- Inconsistent sporadic income

- Ongoing maintenance

- Insurance concerns

38. Rent Out Tools

Have spare tools like ladders, drills, saws, and roto-tillers? Rent them out on sites like Fat Llama when you don't need them.

Pros

- Turn idle assets into cash

- Flexible occasional rentals

- Lower costs than buying tools

Cons

- Sporadic irregular income

- Ongoing maintenance

- Theft and damage risks

39. License Recipes and Meal Plans

Create dieting and meal plans, recipes and tip guides then sell licenses for people to download and use them.

Pros

- Make money while you sleep

- Very high profit margins

- Build and sell cookbooks over time

Cons

- Need strong expertise

- Ongoing recipe creation

- Marketing costs add up

40. Rent out Collectibles

Rent your collectibles like designer handbags, watches and jewelry to people for special events. Command premium daily/weekly pricing.

Pros

- Significant earnings for rare items

- Lower risks than selling outright

- Established platforms available

Cons

- Niche market of renters

- Risks of damage and theft

- Handling logistics

41. Provide Online Lessons

Teach your skill or expertise through online lessons and tutorials. Students pay for access to your pre-recorded content.

Pros

- Make money while you sleep

- Build authority and audience

- Evergreen content pays you repeatedly

Cons

- Major time investment upfront

- Ongoing marketing/lead costs

- Possible support questions

42. Monetize Your Blog Content

If you have an established blog and audience, enable advertising or sponsorships to monetize your content. The revenue is mostly passive.

Pros

- Easiest options like Google AdSense

- Make money from existing content

- More income as traffic grows

Cons

- Won't drive big revenue early on

- Fragmented programs and reporting

- Need lots of pageviews monthly

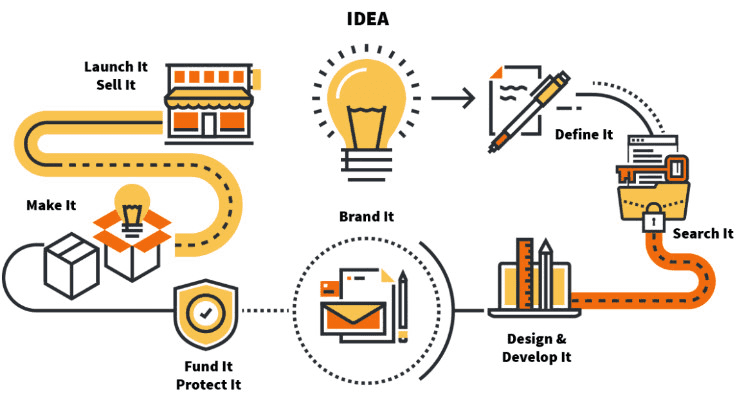

43. License Your Invention Ideas

Invent new products and license the designs/patents for manufacturing and sales to larger companies. Collect licensing fees and royalties.

Pros

- Make money from ideas alone

- Scalable with multiple licenses

- Residual income from royalties

Cons

- Need patents and legal protections

- Identifying licensees can be difficult

- Low odds of commercial success

44. Submit Books to Audible

Record your own audiobooks and submit them to Audible's ACX platform. They then sell the audiobooks online and pay you royalties.

Pros

- Global reach and distribution

- Residual income for years

- Can outsource recording

Cons

- Low royalty percentages

- Need finished book manuscripts

- ACX requirements are strict

Conclusion

Building passive income takes time, effort, and patience, but implementing even just a few of these ideas can lead to long-term financial freedom.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

The key is starting small, focusing on 1-2 income streams that play to your strengths and interests. As these begin generating consistent cashflow, continue reinvesting to scale up and automate where possible.

Diversify across different uncorrelated assets to minimize risk. Leverage any specialized knowledge and capital available to accelerate returns. But remain disciplined - don't overextend yourself or fall for "get rich quick" passive income myths.

With consistent effort over time, the compounding returns of passive income can surpass active work income.

The ideas and strategies in this guide aim to provide inspiration, practical tips, and a roadmap to begin realizing financial independence through passive cashflow. Start today and let your money start working for you.

FAQs:

Ques 1: How much can I make from passive income?

Ans: Income potential varies widely. Some streams like apps can generate thousands per month, others like bank interest just pennies. The key is scaling through multiple streams. Start low-effort ones like affiliate sites first before reinvesting into bigger assets.

Ques 2: What are the easiest starter passive income ideas?

Ans: Beginner friendly ideas include peer-to-peer lending, affiliate marketing, advertising on an existing blog and dividend stocks. These have low barriers to start and require little specialized expertise. Once experienced, branch into more advanced options.

Ques 3: How do I scale up my passive income quickly?

Ans: Utilize leverage, outsourcing and automation to minimize direct involvement yet maximize assets. Invest passively through REITs instead of direct properties. Put rentals on autopay. Automate affiliate commissions. The more passive the assets, the faster you can scale.

Ques 4: What mistakes should I avoid with passive income?

Ans: Don't spread yourself too thin trying too many streams at once. Focus on just 1 or 2 solid income sources rather than 10 mediocre ones. Also beware unrealistic returns with no effort - if it sounds too good to be true, it likely is. Do thorough due diligence.